|

|

|

| |

| |

|

IAMAI Submission to DoT on Draft National Telecom Policy Raises Several

Concerns

The Internet and Mobile Association of India (IAMAI) made a

submission to the Department of Telecommunications (DoT) on the Draft National

Telecom Policy, 2025 (Draft Policy), with a number of suggestions. The IAMAI

requested that the Draft Policy clearly define its scope to exclude broadcasting

and maintain its focus on the core mandate of telecommunication, i.e., carriage

and infrastructure. The submission raised concerns about the proposed broad,

potentially mandatory, data sandbox, and urged the Government to focus on data

contribution under a more defined, controlled, equitable, and importantly,

voluntary framework. The Association submitted that reliance on existing legal

frameworks – grounded in necessity and proportionality was sufficient to safeguard

innovation, security, and user freedom.

The submission highlighted that the Draft Policy should focus on improving the

implementation of existing frameworks to detect unsolicited commercial

communication/spam instead of putting in place any new frameworks. Concern was

also raised relating to cost, feasibility, and legality stemming from the

introduction of a mandatory mobile number validation service (MNVS). The IAMAI

urged the DoT to ensure that the Draft Policy upheld the principles of net

neutrality by ensuring non-discriminatory treatment of internet traffic. With

respect to a proposed regulatory framework to implement active and passive

infrastructure sharing, the IAMAI underlined the importance of ensuring that all

relevant stakeholders affected by any proposed infrastructure sharing initiative

between any service providers, possess the right to assess its potential for

misuse, and to consequently define and implement appropriate remedial actions.

|

|

|

|

|

|

| |

|

IAMAI's Digital Entertainment Committee Raises Concerns with NPCI on UPI Autopay

Restrictions

| The IAMAI's Digital Entertainment Committee (DEC), made a

representation to the National Payments Corporation of India (NPCI) regarding

Operational Circular 215A in July 2025 which places restrictions on the use of ten

UPI APIs, including the UPI Autopay transaction execution API w.e.f. 1st August

2025. In follow-up, the IAMAI Secretariat met with NPCI officials to highlight the

concerns of publishers of online curated content, particularly around the

potential ~2% decline in recoveries because of these restrictions. During the

meeting, IAMAI suggested that NPCI may consider increasing the allowed retries for

failed transactions to at least seven, if not the earlier nine. The NPCI officials

noted IAMAI's concerns and assured that if there was evidence of significant

disruption to subscription services, the NPCI would constitute a task force and

initiate further industry consultations.

|

|

|

|

|

|

| |

|

Digital Entertainment Committee Holds First Meeting Under New Leadership

| The Digital Entertainment Committee (DEC) of the IAMAI held its first meeting on 11th August, 2025 under the leadership of the newly elected Chair, Mr. Kiran Mani of Jio Hotstar, and Co-Chair, Mr. Deepit Purkhayastha of Inshorts. Members discussed the need for a comprehensive and forward-looking industry report that captures the growth of the digital entertainment sector. Members also emphasized the importance of IAMAI being part of the task force on privacy, being set up by the Ministry of Information and Broadcasting, especially in light of the piracy report released last year by IAMAI together with EY.

|

|

|

|

|

|

| |

|

IAMAI, NITI Aayog Publish Report on 'Rethinking Homestays: Navigating Policy

Pathways'

| The Internet and Mobile Association of India (IAMAI), in

collaboration with NITI Aayog, published a report titled 'Rethinking Homestays:

Navigating Policy Pathways' . The report outlines a strategic roadmap to catalyse

the homestay and BnB sector as a driver of sustainable tourism, local

entrepreneurship, and inclusive economic development in India. It was released by

Shri Suman Bery, Vice Chairman, NITI Aayog. Senior officials of the Ministry of

Tourism, Ministry of Culture, and state governments including Goa, Kerala,

Uttarakhand, and Uttar Pradesh, as well as Industry stakeholders from Airbnb,

MakeMyTrip, ISPP, and Chase India were present at the launch of the report.

|

|

|

|

|

|

| |

|

PCI Submission to RBI on Audit Standardisation

| In continuation of its long-term efforts around Audit

Standardisation the IAMAI's Payments Council of India (PCI) submitted a detailed

document on PA Audits to the Reserve Bank of India (RBI). The document highlighted

the regulatory overlaps and repetitions across various guidelines. The submission

was followed by meetings with RBI on the same issue.

|

|

|

|

|

|

| |

|

PCI Submission to RBI on Numberless Card Proposal Underlines Security,

Inclusivity

| The PCI Cards Network Committee submitted industry feedback to the RBI

regarding the proposal to remove card details (e.g., number, expiry, CVV) from the

surface of physical payment cards. The industry highlighted the need for a secure,

inclusive, and user-friendly approach aligned with the RBI's goal of strengthening

payment system resilience.

|

|

|

|

|

|

| |

|

FCC Representation on Challenges in Implementing Portions of the Digital Lending

Directions, 2025

| The IAMAI's Fintech Convergence Council (FCC) made a representation to

the Reserve Bank of India (RBI), regarding the 'Practical Challenges in Implementing'

para 6 of the Digital Lending Directions (DLD), 2025. While supportive of the framework

of the DLD, the FCC expressed concerns over the complexity of execution and the broader

impact on the lending ecosystem. The representation also recommended a more flexible and

pragmatic approach to the implementation of the Digital Lending Directions.

|

|

|

|

|

|

| |

|

FCC Submission to SEBI Suggests Creation of MCC and Enhancing Net-Banking Limits for

PMS and AIF Managers

| The FCC made a submission to the Securities and Exchange Board of India

(SEBI), seeking the creation of a distinct Merchant Category Code (MCC) for transactions

pertaining to Portfolio Management Services (PMS) and Alternative Investment Funds

(AIF). The submission also included a suggestion on exempting PMS and AIF from upper

net-Banking transaction limits, to improve ease of transactions and enhance efficiency

for investors and service providers. This representation aims to streamline operations

for PMS and AIF players in the ecosystem, removing bottlenecks, and achieving higher

efficiency.

|

|

|

|

|

|

| |

|

FCC Submission to Union Consumer Affairs Ministry Suggests Regulatory Recognition of

Digital Gold

| The FCC, in consultation with digital gold ecosystem players, made a

submission to the Union Ministry of Consumer Affairs suggesting regulatory recognition

of Digital Gold. The submission highlighted the widespread impact that the regulation of

Digital Gold can have for consumers as well as the economy as a whole. This aims to

bring oversight to a historically unregulated space, ensuring better consumer protection

while encouraging confidence among investors engaging in digital gold products.

|

|

|

|

|

|

| |

|

Click 2025 Emerges as India's Leading Performance and Growth Marketing

Conference

Delegates engrossed at a full house session at Click

2025

The Internet and Mobile Association of India (IAMAI) organised India's

leading performance and growth marketing conference, Click 2025, on August 20-21, 2025

at Andaz, New Delhi. Carrying the decade-long legacy of one of India's foremost

affiliate marketing conference the India Affiliate Summit, Click 2025, appeared with a

new name and far wider scale. The conference brought together top marketers, industry

leaders, and innovators to discuss emerging trends and strategies in performance

marketing. It registered over 6000 footfall, and more than 100 speakers from the digital

marketing ecosystem addressed over 20 sessions across two days, including 25+

masterclasses and case studies.

Among the major speakers at CLICK 2025 were Lee-Ann Johnstone - Founder, Affiverse;

Rajiv Dubey - Vice President - Marketing, Dabur India; Sidharth Shakdher - CMO &

Business Head, Paytm; Vikram Singh - Digital Marketing Head, ITC Hotels; Anchit Chandra

- Digital Marketing Head & CRM, Muthoot Fincorp ONE; Dennis Yu - CEO, Blitz Metrics;

Parul Bhargava - CEO, vCommission; Srikanth Bureddy - Co-founder, Valueleaf; Sanjay

Sindhwani - CEO, Indian Express Digital; Meetu Mulchandani - Head, Brand Factory, Honasa

Consumer; Prajakta Rathe - Deputy General Manager, Reliance Retail; Chanpreet Arora -

Chief Business Officer, Wholsum Foods (Slurrpfarm & Mille); Simon Stanley - Head of

Affiliates, Kaspersky; and Pankaj Sharma - CEO & Director, MGID.

The partners of CLICK 2025 were vCommission, Valueleaf, Singhtek, Apptrove by Trackier,

Confluencr, MGID, Affise, GrabOn and Offer18. The conference is also supported by ONDC.

|

|

|

|

|

|

| |

|

IAMAI's DAC Organise Insightful Roundtable on Mastering Media in the Age of

AI

The Digital Advertising Council (DAC) of the Internet and Mobile

Association of India organised a closed-door roundtable, titled 'Beyond India', focusing

on the theme 'Mastering Media in the Age of AI with Clarity, Control and Confidence', on

August 20, 2025, at Andaz, New Delhi. The roundtable brought together top marketers,

media leaders, and digital innovators to unpack the trends redefining the advertising

industry. The programme was designed as a strategic dialogue on how to drive

performance, protect brand equity, and future-proof media strategy, especially with the

upcoming holiday buying season in focus.

Participants of the Beyond India roundtable after the

session

Among the key speakers at the roundtable were Amit Khanduja, Global Lead, TCS; Anjali

Dutta, Digital Transformation & Marketing Leader, Tech Mahindra; Anshul Minocha, Deputy

VP, Postcards Hotels; Debikalyan Dash, Senior Manager - Performance Media and Brand

Commerce, ITC; Himanshi Kharoo, Head of Sales and Marketing, Mahindra Group; Jigar

Rathod, Digital Media Manager, Adidas; Kanika Tomar, Media and Digital Orchestration

Lead, Chanel; Kunal Singhal, Lead Digital Media & E-Commerce Performance Marketing, Boat

Lifestyle; Nikita Singh, Marketing, Brand & Digital Specialist, Fortis Healthcare, and

Purvaa Kapadia, Head of Marketing, Marks & Spencer.

|

|

|

|

|

|

| |

|

PCI-FCC Knowledge Session on LEIs and Regulatory Compliance

| The Payments Council of India (PCI) and the Fintech Convergence Council

(FCC), in collaboration with the Global Legal Entity Identifier Foundation (GLEIF),

hosted a session on Legal Entity Identifier (LEI) and Regulatory Compliance on 13th

August 2025. Mr. Vikas Panwar, Country Business Manager, GLEIF, addressed the knowledge

session. He explained mandatory requirements for obtaining and using LEIs in India and

their role in payments, securities trading, and derivative contracts. The session saw

participation from more than 90 attendees.

|

|

|

|

|

|

| |

|

FCC Knowledge Session on 'How Global Sanctions are Evolving and What that means for

India's Fintech Ecosystem'

| The FCC's Digital Lending Committee conducted a session on 7th August

2025, on 'How Global Sanctions are Evolving and What that Means for India's Fintech

Ecosystem'. The session was addressed by Mr. Mike Meadon, Director-Asia Pacific, LSEG

(London Stock Exchange Group) Risk and Intelligence. The session explored the Global

Sanction Index for policy and risk controls, privatization trends, extraterritorial

reach of sanctions, and risks for Indian businesses. It also highlighted practical

considerations for sanctioning screening standards. Over 100 industry professionals

participated in it.

|

|

|

|

|

|

| |

|

FCC-UIDAI Knowledge Session on Face Authentication & Revised SWIK Rules

| The FCC, in collaboration with Unique Identification Authority of India

(UIDAI), organized a knowledge session on 8th August 2025, on 'Face Authentication &

Revised SWIK (Social Welfare, Innovation, Knowledge) Rules'. The session was addressed

by Mr. Akshaya Yadav, Director, Unique Identification Authority of India (UIDAI). He

highlighted key updates on SWIK Rules and practical insights on face authentication and

discussed regulatory perspectives and implementation aspects for the financial

ecosystem. More than 120 industry professionals attended the session.

|

|

|

|

|

|

| |

|

MCX-FCC Sign MoU to Launch Investor Awareness Campaign

| The FCC and the Multi Commodity Exchange of India Ltd. (MCX) have signed

a Memorandum of Understanding (MoU) to launch a social media campaign aimed at

increasing investor awareness. The initiative aims to empower investors with the

information they need to make informed financial decisions. The campaign will go live on

15th September 2025.

|

|

|

|

|

|

| |

|

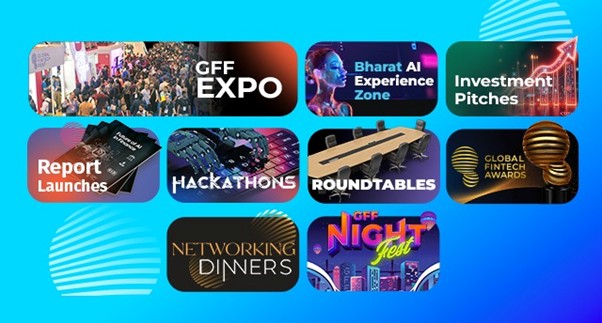

Global Fintech Fest 2025: All Set For October 7-9

Unique Mix of Insights, Networking and Exposure to

Cutting-edge Technology

The movers and shakers of the global fintech ecosystem are all set to converge under one

roof for three days, October 7-9, at the Global Fintech Fest (GFF) 2025, the world's

largest fintech conference, being organised by the Payments Council of India (PCI), the

National Payments Corporation of India (NPCI) and the Fintech Convergence Council (FCC).

Policymakers, central bankers, industry captains, investors, and academicians will

deliberate on how to leverage fintech to build a better world, in alignment with the

overarching theme of GFF 2025: 'Empowering finance for a better world powered by

AI'.

True, insights from financial ecosystem experts will be at the heart of the conference.

However, GFF 2025 is designed to be much more than just speaking sessions. A special

attraction of the conference this year will be the Bharat AI Experience Zone by NPCI and

NVIDIA. There will also be a huge expo, with more than 400 exhibitors showcasing the

latest in fintech. These apart, a plethora of ancillary activities such as workshops,

hackathons, investment pitches, fintech awards, and numerous networking events,

including Night Fests and gala dinners are designed to turn the conference into a unique

mix of insights, deep and wide networking and exposure to cutting-edge technology: an

unmatched festival of the fintech sector.

|

|

|

|

|

| |

| |

|